Your Partner for Expert Guidance

in Mergers & Acquisitions and Capital Raising

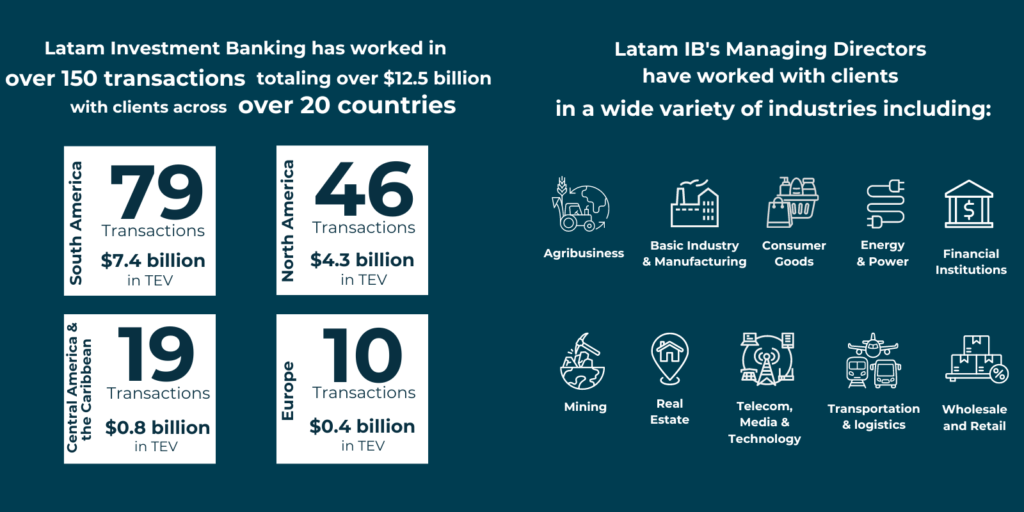

Latam Investment Banking advises mid-market companies in Latin America and the U.S. Hispanic market on the sale and acquisition of businesses and on capital raising through private equity, private debt, and alternative financing solutions beyond traditional commercial bank loans.

Led by partners with more than 30 years of experience each, the firm has advised on over 150 transactions totaling more than USD 10 billion, delivering disciplined execution and deep regional expertise in complex cross-border transactions.

Our clients benefit from our ability to manage complex transactions and provide access to alternative capital providers.

Comprehensive Investment Banking Solutions

for Your Success

Sale & Acquisitions

Capital Raising

Senior Bankers

Our Managing Directors are prominent figures in the field of investment banking, boasting extensive expertise in the industry.